Fascination About Federated Funding Partners Legit

Table of ContentsFacts About Federated Funding Partners Legit UncoveredThe Single Strategy To Use For Federated Funding Partners BbbThe 30-Second Trick For Federated Funding PartnersThe 10-Second Trick For Federated Funding Partners LegitWhat Does Federated Funding Partners Legit Do?

16 a month for 24 months to bring the equilibrium to absolutely no. This exercises to paying $2,371. 84 in passion. The monthly savings would be $115. 21, and also a financial savings of $2,765. 04 over the life of the funding. Also if the monthly repayment remains the same, you can still appear in advance by improving your loans.91 * 3) $1,820. 74 * 3) $20,441. 22 Nonetheless, if you transfer the equilibriums of those three cards right into one consolidated car loan at an extra practical 12% rate of interest rate and also you continue to settle the financing with the exact same $750 a month, you'll pay roughly one-third of the rate of interest$ 1,820.

This totals up to a total cost savings of $7,371. 51$ 3,750 for settlements and also $3,621. 51 in interest.

Have you maxed out your bank card? Are you having a hard time to repay money you've obtained!.?.!? Paying off that new vehicle in the driveway? Juggling all of your debts can be an examination of your multitasking skills, and also your sanity. By settling your debts, you can make your life simpler as well as begin living debt-free.

The Greatest Guide To Federated Funding Partners Legit

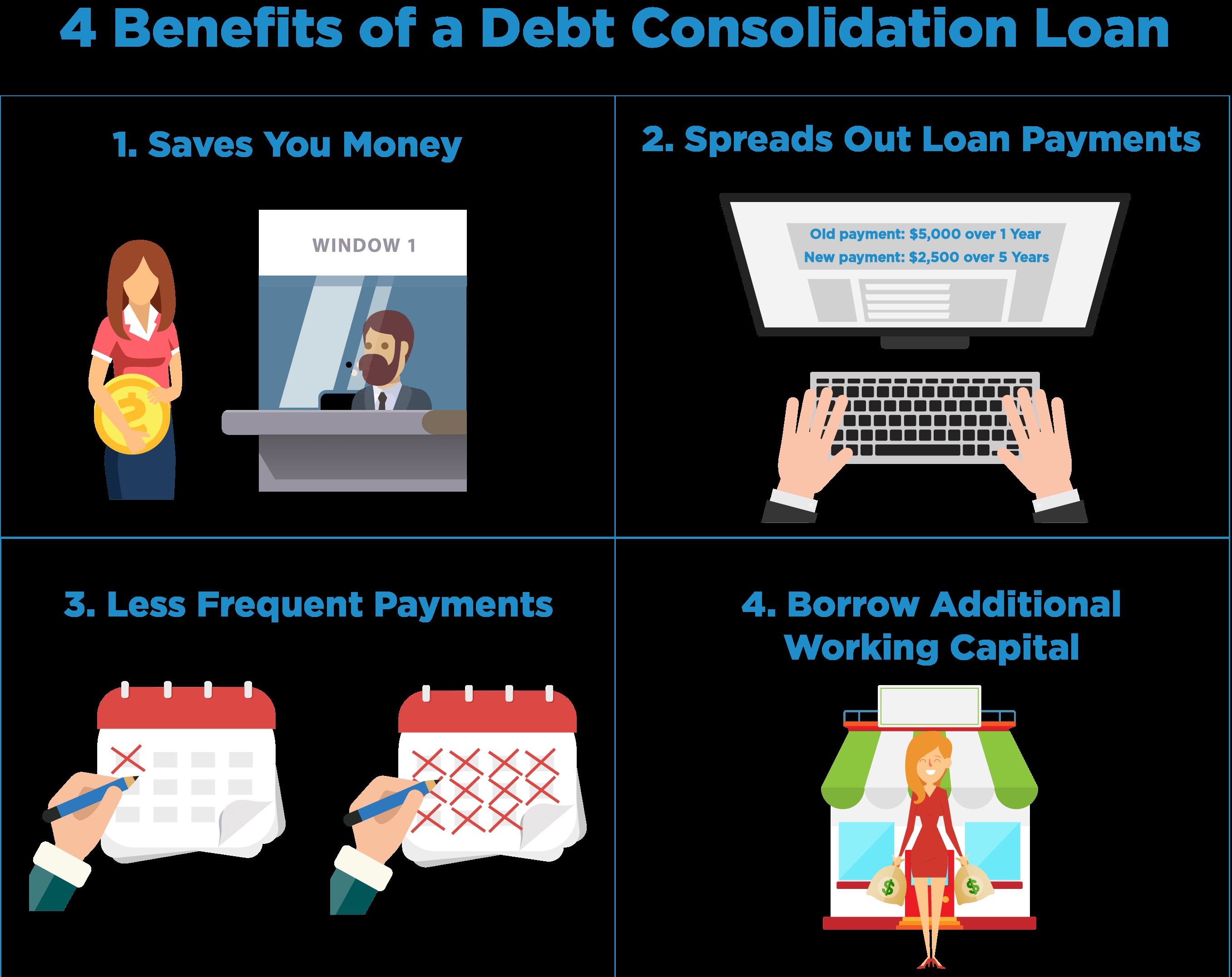

The benefits of financial debt combination don't end there: Financial obligation loan consolidation loans are billed at a much reduced price than all of your individual car loans or debts, such as hire purchases or credit history cards. The ordinary New Zealander is currently strained with document levels of financial debt. Chances are, you're one of them.

Some of your finances may be due by the end of the month. A debt loan consolidation lending makes life very easy, providing you simply the one monthly payment and a settlement term that is frequently a lot longer than your existing debts.

Who do you owe money to? When is payment due? They each featured their very own terms, problems, rates and settlement days. Handling everyday life is difficult enough without the included stress of several creditors taking a breath down your neck, which is why settling your financial debts into the one lending is so reasonable.

Life's a marathon, not a sprint. Yet you're probably running a million miles a hr just to maintain. It's easy to neglect a payment when you're so active. The resulting late costs, fees, as well as feasible lasting marks versus your credit history record are an unnecessary inconvenience. With just the one loan? There's absolutely nothing to fail to remember.

Excitement About Federated Funding Partners Legit

Emergency situation expenses and also substantial bank card use can land you in a sticky monetary situation where you're left paying high-interest prices on all types of financial obligation. In this situation, debt loan consolidation can be a viable choice to help try the financial debt as well as perhaps pay it off faster. Right here are simply a couple of advantages of the debt combination procedure.

Pay Off High Passion Bank Card Balances Most credit cards make use of rotating debt. This means you can make use of as much or as little of the max quantity established by the bank card firm. While it's good to have that versatility when you require accessibility to debt, several find it hard not to spend too much as well as fall under huge Visit Website credit report card debt.

This type of loan is thought about an installation financing. This implies there's a definite beginning as well as endpoint. By relocating your bank card financial debt to a personal loan, you'll have the ability to pay it off swiftly as well as conserve in lifetime rate of interest. 2. Appreciate a Reduced Rate Of Interest Relying on the terms set by your credit report card business, your minimum monthly settlement might be going to pay off the month-to-month passion, not lowering your overall balance.

Federated Funding Partners Legit Can Be Fun For Everyone

A financial debt consolidation financing is typically pointed out as a rewarding financial solution for individuals that are taking care of a great deal of different debts. What are the benefits that may be appreciated by utilizing a debt combination financing as an economic remedy? 1. One Settlement As Opposed To A Number Of Among the most significant difficulties with taking care of several financial obligations is taking care of the number of payments that leave your bank account every month.

What's even more, taking out a financial obligation combination financing will frequently suggest you have longer to pay. Your settlement duration may be much longer you'll may still conserve cash, as rate of interest will typically be reduced and also you will not be building up any even more interest on your existing financial debts.

With a financial obligation consolidation lending, the overall passion you will pay will certainly commonly be reduced versus what you 'd pay on charge card. While you ought to examine the rate of interest of a financial debt loan consolidation financing before getting one, it may be an option that can bring about money cost savings. This is definitely true if you deal with a scenario comparable to the one above, where you're monetarily 'treading water' as well as doing no greater than repaying the interest each month.

Some Known Incorrect Statements About Federated Funding Partners Reviews

While you should examine the rate of interest of a financial obligation loan consolidation funding prior to applying click for more info for one, it might be a remedy that can result in money cost savings." 4. Assist with Your Credit report The simplest method to consider this is to imagine you proceeding with your a knockout post present monetary circumstance versus getting a debt loan consolidation lending.